After

lengthy investigations, the Australian Securities and Investments Commission

(ASIC) has filed criminal charges in two financial misconduct cases. In the

first case, Joseph Cullia and Zoran Markovic were charged with offenses related

to an alleged self-managed super fund (SMSF) investment scam. In the second

matter, Aryn Hala was charged with providing unlicensed financial services

through his crypto-assets company.

According

to ASIC, two Melbourne men (Cullia of Southbank and Markovic of Coburg) were

charged with offenses related to the SMSF scam from November 2020 to July 2021.

The men allegedly operated fraudulent websites that promised high investment

returns. The sites improperly used the licenses of legitimate financial

companies without their consent.

Cullia was

charged with two counts of conspiracy to defraud, two counts of money

laundering, and one count for possessing false documents and another for stolen

identification. The money laundering charges each carry potential penalties of up

to 25 years in prison.

Markovic

was charged with 13 counts of aiding the money laundering offenses, along with

possession of false documents, stolen identification, and equipment to create

false IDs. He faces up to 12 months imprisonment on the charges.

At the end

of last month, the regulator reported another Australian who, despite a 10-year

ban on operating in financial markets, managed to open five more investment

companies during this time. Even $8 million in financial penalties did not

deter him.

Fake 20% Return from

Crypto Investments

In the

second misconduct case, Hala of Redbank Plains, Queensland, was accused of

providing unlicensed financial services through his company, A One Multi

Services Pty Ltd. He allegedly promised investors annual returns of up to 20%

if they opened SMSFs and invested retirement savings into crypto-assets through

his company.

Hala was

charged with nine counts of operating an unlicensed financial services

business, each carrying a maximum 5-year prison sentence. He allegedly

encouraged retirement savers to transfer funds to SMSFs under his control.

Court-appointed receivers have been unable to recover most investor assets.

ASIC warned

about the exploitation of SMSFs by cryptocurrency scammers as early as the

beginning of 2022. It reminded that in the case of these funds, the ultimate

responsibility lies with retail investors.

Both Cullia,

Markovic, and Hala were released on bail. The criminal charges follow ASIC

investigations into suspected misconduct involving retirement savings. ASIC

warns Australians to invest retirement funds cautiously. The Commonwealth

Director of Public Prosecutions is prosecuting the matters.

After

lengthy investigations, the Australian Securities and Investments Commission

(ASIC) has filed criminal charges in two financial misconduct cases. In the

first case, Joseph Cullia and Zoran Markovic were charged with offenses related

to an alleged self-managed super fund (SMSF) investment scam. In the second

matter, Aryn Hala was charged with providing unlicensed financial services

through his crypto-assets company.

According

to ASIC, two Melbourne men (Cullia of Southbank and Markovic of Coburg) were

charged with offenses related to the SMSF scam from November 2020 to July 2021.

The men allegedly operated fraudulent websites that promised high investment

returns. The sites improperly used the licenses of legitimate financial

companies without their consent.

Cullia was

charged with two counts of conspiracy to defraud, two counts of money

laundering, and one count for possessing false documents and another for stolen

identification. The money laundering charges each carry potential penalties of up

to 25 years in prison.

Markovic

was charged with 13 counts of aiding the money laundering offenses, along with

possession of false documents, stolen identification, and equipment to create

false IDs. He faces up to 12 months imprisonment on the charges.

At the end

of last month, the regulator reported another Australian who, despite a 10-year

ban on operating in financial markets, managed to open five more investment

companies during this time. Even $8 million in financial penalties did not

deter him.

Fake 20% Return from

Crypto Investments

In the

second misconduct case, Hala of Redbank Plains, Queensland, was accused of

providing unlicensed financial services through his company, A One Multi

Services Pty Ltd. He allegedly promised investors annual returns of up to 20%

if they opened SMSFs and invested retirement savings into crypto-assets through

his company.

Hala was

charged with nine counts of operating an unlicensed financial services

business, each carrying a maximum 5-year prison sentence. He allegedly

encouraged retirement savers to transfer funds to SMSFs under his control.

Court-appointed receivers have been unable to recover most investor assets.

ASIC warned

about the exploitation of SMSFs by cryptocurrency scammers as early as the

beginning of 2022. It reminded that in the case of these funds, the ultimate

responsibility lies with retail investors.

Both Cullia,

Markovic, and Hala were released on bail. The criminal charges follow ASIC

investigations into suspected misconduct involving retirement savings. ASIC

warns Australians to invest retirement funds cautiously. The Commonwealth

Director of Public Prosecutions is prosecuting the matters.

link

More Stories

Intact Financial Corporation launches Wildfire Defense Systems service to limit wildfire damage to homes

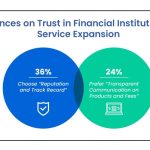

“60% of Clients Don’t Trust Financial Institutions”: Fintech’s Customer-Centric Shift

hearing | Hearings | United States Committee on Banking, Housing, and Urban Affairs